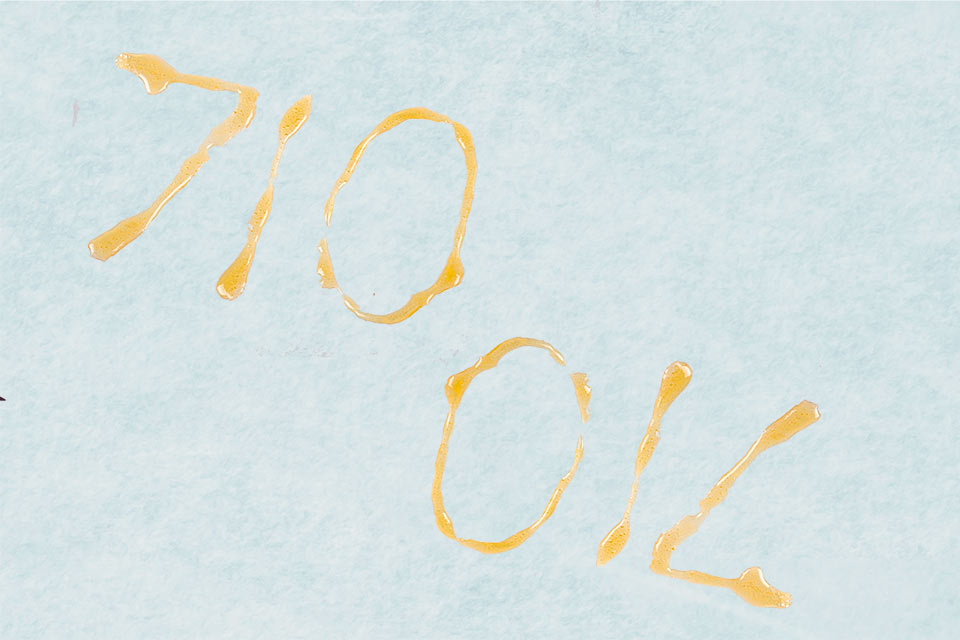

As cannabis companies across the U.S. set up to celebrate the relatively new cannabis holiday of 710, California operators are adapting to new vape regulations and rethinking strategies for the product category, industry leaders say.

The new regulations prohibit using the term “disposable” for vape products and mandate clearer disposal instructions, in an effort to reduce e-waste and improve consumer education.

“These products were being marketed as disposables, but they’re not actually disposable in the sense that you can’t throw them in a trash can,” Laura Fogelman, vice president of communications at cannabis vape company PAX, told Green Market Report.

In particular, the new rules address safety concerns with lithium-ion batteries in vape devices, she said.

“We have seen an uptick in explosions and fires, because these batteries, when they get wet, can combust,” Fogelman explained.

On top of the rules putting somewhat of a damper on a holiday that focuses on the concentrates used in vapes, some operators are shifting their focus away from cannabis-centric holidays and leaning into other sales periods, such as the Fourth of July.

“If you go into a retailer tied to 4/20 or 710, it’s all about deals and promotions and kind of the cheapest products,” Fogelman said. “We’re trying to bring that value to consumers at other moments where we can kind of stand out a little bit more.”

All-in-one

With the new rules, operators in the state are transitioning to new terminology, with “all-in-one” replacing “disposable” for certain vape products. However, Oliver Summers, president of retail operations at United Patient Alliance in Sun Valley, voiced concerns about the impact of such moves on more diverse communities.

“It might help some people,” he said. “But again, it’s all about changing people’s vernacular. And in my neighborhood, I deal with a lot of Latin and Armenian people who don’t really speak English very well altogether. So it’s going to be something to watch over the next few weeks.”

Summers even joked about the potential confusion, saying, “We’re gonna put up a big sign that says, ‘Don’t use the word disposable.’ Yeah, that’s gonna be the new thing. I call dibs on the Etsy.” He added humorously, “You have to walk outside and then come back in again,” referencing the old practice in head shops where customers had to leave and re-enter if they used prohibited terms.

At the same time, consumer education is especially important in an environmentally conscious state such as California, where a single spark can wreck entire swaths of ecosystem.

“Consumer education is so important here,” Fogelman said. “And at the end of the day, consumer behavior shapes markets.”

Companies such as PAX have been trying to stay ahead on the sustainability front for a while. The brand has introduced products using ocean-bound plastic and obtained “plastic negative” certification, she added.

Summers said United Patient Alliance also has programs already in place, such as its existing recycling initiative, to support the new regulatory scheme.

Feeling out the market

What the new rules don’t do is address broader challenges in the California cannabis industry. Summers pointed to the usual market saturation: “Unfortunately, nowadays, you know, as we all have so much of the similar products on our shelves … it makes it a little tough to be more exciting.”

Despite challenges faced by individual operators, data from wholesale cannabis platform LeafLink suggests a robust market for concentrates heading into 710. According to firm, concentrate sales expand strongly in the lead-up to July 10, with wholesale gross merchandise volume (GMV) per day up 13% relative to the rest of the year.

This year’s 710 could be the biggest yet, as total GMV and orders of the form factor up 10-15% year-over-year, according to LeafLink’s data.

But it’s not the same old products flying off the shelf. Data shows non-distillate concentrates gaining popularity, increasing by more than 30% in the last two weeks of June compared to the same period in 2023, marking the strongest growth for any form factor.

Live resin and rosin have also grown to account for over 20% of finished concentrate sales on the marketplace, up from just 6% three years ago.

California Cannabis Updates1 year ago

California Cannabis Updates1 year ago

Breaking News1 year ago

Breaking News1 year ago

best list11 months ago

best list11 months ago

Bay Smokes12 months ago

Bay Smokes12 months ago

cbd1 year ago

cbd1 year ago

Business9 months ago

Business9 months ago

Mississippi Cannabis News1 year ago

Mississippi Cannabis News1 year ago

Breaking News1 year ago

Breaking News1 year ago